- About Us

- Legal Services

- Family Law

- Property

- Marriage

- Immigration

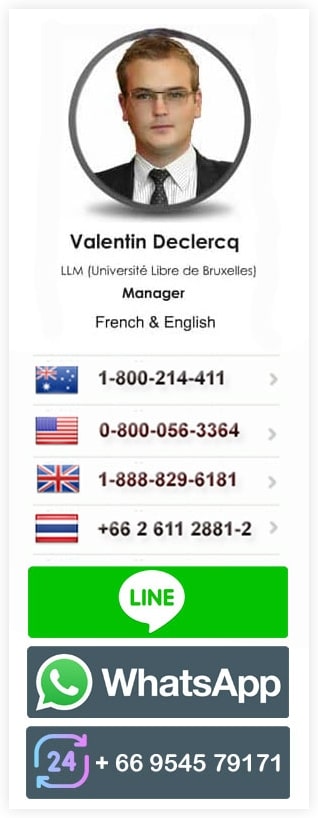

- Contact

- Payments

Good news to those who are doing business in Thailand and those who are planning to set up a business in the Kingdom. The current administration has approved corporate tax reduction from the usual 30% rate to 23 % effective next year, 2012. Another reduction is to be implemented the following year, 2013 bringing the corporate tax rate to 20%. The corporate tax reduction scheme proposed by Ministry of Finance is aimed at encouraging more direct investments by foreign investors into Thailand.

This year being 2024 the corporate taxes in Thailand is currently 20% for most companies. That is the average as it will also depend on the size of the company. The smaller companies with smaller profits benefit from progressive rates: 0% on profits up to THB 300,000. Likewise its currently 15% for profits between THB 300,001 and THB 3 million. Additionally for foreign companies not conducting business in Thailand but earning income from the country. There will be a withholding taxes of 15% generally apply, except for dividends, which are taxed at 10%. Lastly see also the article that we wrote on business license application as well as building restrictions in Thailand for those who are starting a restaurant.

For more information with regard to starting a business in Thailand, feel free to contact us any time by email, live chat, phone or personal visit at any of our offices in Thailand.

Update

This was from 2013 so speak to us as a litigation law firm in Thailand for the latest changes.